Gartner 2010 Magic Quadrant for Business Intelligence

One of the most respected sources of ratings of Business Intelligence platforms (tools/tool-stack) is the Gartner Magic Quadrant. Now that the 2010 Magic Quadrant is out, let's take a deep dive into it.

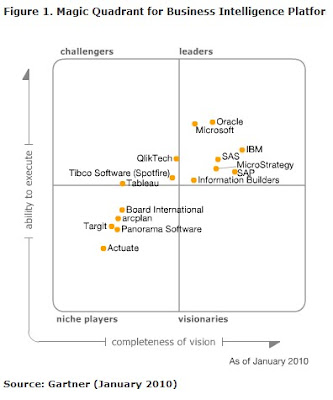

Let us focus on the 4th Quadrant. There are 7 players here namely Oracle (Siebel/Hyperion), IBM (Cognos/SPSS), SAP (Business Objects) and Microsoft - the large infrastructure service providers (or mega vendors) and then the independent BI providers like SAS, Microstrategy and Information Builders. All other are essentially in the niche player category...and in my opinion more suitable for specific company needs rather than go-forward strategy for entire enterprise wide BI initiative.

Gartner notices that though mega-vendors account for over 75% of BI Platform, the pure-play or niche vendors are not loosing ground and companies are sometimes impatient with results from large BI projects and turn to smaller vendors for more point solutions. Departments acting as independent cost centers are under pressure to show immediate results and select departmental solutions for quicker ROI without necessary alignment withe corporate BI & DW direction.

Tableau is a new entrant into the Quadrant. It is good to see that users are placing increasing importance to visualization of data - as they say a picture is worth many times the text or numeric reports. Gartner feels that players like Tableau with the "surf and save" model are becoming challengers to the mega-players.

Gartner survey reveals that customer satisfactions is higher for Oracle customers on the Siebel / Hyperion front compared to IBM and SAP where the Cognos and Business Objects acquisition impact is still out there for the customers.

Oracle and Microsoft stand high on ability of execute. IBM and SAP are on the higher end of being visionaries. IBM incidentally has received overall highest number of patents for 17 years in a row! Another trend is the "completeness of [BI] vision" and that will lead to increasing integration of predictive analysis and features like visualization into core BI functionality. Oracle is also focusing on integration of BI into the Oracle Applications (e-Business Suite) to strengthen in Operational BI and provide insights to users of ERP software, at their finger tips. This is apart from the Oracle BI Application effort, which is a Data Warehousing offering with ERP applications like EBS, Siebel CRM, Peoplesoft and now JD Edwards.

So how did recession impact the BI space? We see Microsoft has gained quite a few points on the Magic Quadrant. Though SQL server has its sweet spot in SMB space - small & medium businesses as it runs on Microsoft Servers only, yet on the BI side, it seems it's increasing maturity has increased it's market share as a lower cost BI platform. However, I personally doubt due to lack of integration with the major ERP systems like SAP or Oracle EBS, how far will this trend go for Microsoft as Enterprise BI platform?

Myself, coming from a BI Systems Integrator company IBM - Global Business Services (which is the largest Oracle Service provider - Refer Forrester Wave 2009 Q4), it is heartening to read "Gartner's view is that the market for BI platforms will remain one of the fastest growing software markets despite the economic downturn." This means a lot of new business for the SI's with BI / DW and EPM (Enterprise Performance Management) expertise. Though BI dropped from top (2009) to #5 (2010) initiative per the CIO survey, there will be alternative forms of BI initiatives like in conjunction with Cloud Computing and BI for getting value out of multimedia and unstructured data in the enterprise. Likewise, BI's ties with social and collaboration software will gain importance.

Some of the key vendor specific observations by Gartner

"IBM Cognos customers reporting that they need only three administration staff per thousand users on average."

"Oracle has established the Oracle BI Enterprise Edition (OBIEE) platform as the "BI standard" in 82% of the references that responded to our Magic Quadrant survey. "

"Oracle has created within its references a very positive perception of its vision and success."

"Oracle lags behind the competition in introducing new and innovative solutions, such as the ability to integrate interactive visualization, search and collaboration as part of the BI platform offering."

"Surveyed customers continue to indicate that OBIEE, for the developer role, is more difficult to use, on average, than other BI platforms."

"SAP BusinessObjects' reporting and ad hoc query capabilities continue to be cited as its top strength by its customers..."

"For the third year in a row, customer survey data shows that customer support ratings for SAP are lower than for any other vendor in our customer survey."

"SAS customers rate their sales experience with SAS above average, despite complaints about pricing"

"Tableau was chosen more often for functionality than any other vendor in the survey"

What surprises me most though that Gartner did not comment on Datawarehouse or Database Appliances in the context of BI! Are we awaiting a new Magic Quadrant for Datawarehouse Appliances that will compare Exadata, Netezza, Teradata and the like?

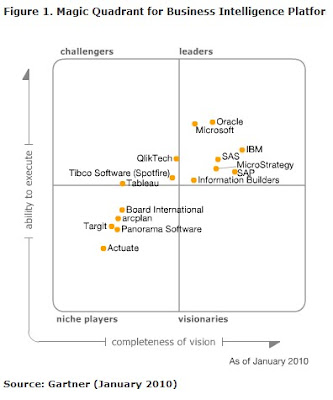

Let us focus on the 4th Quadrant. There are 7 players here namely Oracle (Siebel/Hyperion), IBM (Cognos/SPSS), SAP (Business Objects) and Microsoft - the large infrastructure service providers (or mega vendors) and then the independent BI providers like SAS, Microstrategy and Information Builders. All other are essentially in the niche player category...and in my opinion more suitable for specific company needs rather than go-forward strategy for entire enterprise wide BI initiative.

Gartner notices that though mega-vendors account for over 75% of BI Platform, the pure-play or niche vendors are not loosing ground and companies are sometimes impatient with results from large BI projects and turn to smaller vendors for more point solutions. Departments acting as independent cost centers are under pressure to show immediate results and select departmental solutions for quicker ROI without necessary alignment withe corporate BI & DW direction.

Tableau is a new entrant into the Quadrant. It is good to see that users are placing increasing importance to visualization of data - as they say a picture is worth many times the text or numeric reports. Gartner feels that players like Tableau with the "surf and save" model are becoming challengers to the mega-players.

Gartner survey reveals that customer satisfactions is higher for Oracle customers on the Siebel / Hyperion front compared to IBM and SAP where the Cognos and Business Objects acquisition impact is still out there for the customers.

Oracle and Microsoft stand high on ability of execute. IBM and SAP are on the higher end of being visionaries. IBM incidentally has received overall highest number of patents for 17 years in a row! Another trend is the "completeness of [BI] vision" and that will lead to increasing integration of predictive analysis and features like visualization into core BI functionality. Oracle is also focusing on integration of BI into the Oracle Applications (e-Business Suite) to strengthen in Operational BI and provide insights to users of ERP software, at their finger tips. This is apart from the Oracle BI Application effort, which is a Data Warehousing offering with ERP applications like EBS, Siebel CRM, Peoplesoft and now JD Edwards.

So how did recession impact the BI space? We see Microsoft has gained quite a few points on the Magic Quadrant. Though SQL server has its sweet spot in SMB space - small & medium businesses as it runs on Microsoft Servers only, yet on the BI side, it seems it's increasing maturity has increased it's market share as a lower cost BI platform. However, I personally doubt due to lack of integration with the major ERP systems like SAP or Oracle EBS, how far will this trend go for Microsoft as Enterprise BI platform?

Myself, coming from a BI Systems Integrator company IBM - Global Business Services (which is the largest Oracle Service provider - Refer Forrester Wave 2009 Q4), it is heartening to read "Gartner's view is that the market for BI platforms will remain one of the fastest growing software markets despite the economic downturn." This means a lot of new business for the SI's with BI / DW and EPM (Enterprise Performance Management) expertise. Though BI dropped from top (2009) to #5 (2010) initiative per the CIO survey, there will be alternative forms of BI initiatives like in conjunction with Cloud Computing and BI for getting value out of multimedia and unstructured data in the enterprise. Likewise, BI's ties with social and collaboration software will gain importance.

Some of the key vendor specific observations by Gartner

"IBM Cognos customers reporting that they need only three administration staff per thousand users on average."

"Oracle has established the Oracle BI Enterprise Edition (OBIEE) platform as the "BI standard" in 82% of the references that responded to our Magic Quadrant survey. "

"Oracle has created within its references a very positive perception of its vision and success."

"Oracle lags behind the competition in introducing new and innovative solutions, such as the ability to integrate interactive visualization, search and collaboration as part of the BI platform offering."

"Surveyed customers continue to indicate that OBIEE, for the developer role, is more difficult to use, on average, than other BI platforms."

"SAP BusinessObjects' reporting and ad hoc query capabilities continue to be cited as its top strength by its customers..."

"For the third year in a row, customer survey data shows that customer support ratings for SAP are lower than for any other vendor in our customer survey."

"SAS customers rate their sales experience with SAS above average, despite complaints about pricing"

"Tableau was chosen more often for functionality than any other vendor in the survey"

What surprises me most though that Gartner did not comment on Datawarehouse or Database Appliances in the context of BI! Are we awaiting a new Magic Quadrant for Datawarehouse Appliances that will compare Exadata, Netezza, Teradata and the like?

Comments